Looking for actionable Debt-Free Tips in today’s fast-paced world, where managing finances can be challenging? The good news is that with strategic planning and disciplined habits, it’s possible to achieve both debt freedom and your savings goals. In this blog post, we’ll delve into effective strategies that can help you save money and accelerate your journey towards financial independence.

Create a Budget

The foundation of financial success lies in creating a comprehensive budget. List all your sources of income and track your expenses diligently. This will give you a clear picture of where your money is going and enable you to identify areas where you can cut back.

Prioritize High-Interest Debt

If you’re carrying multiple debts, prioritize paying off the ones with the highest interest rates first. By doing so, you’ll save money in the long run and reduce the overall time it takes to become debt-free.

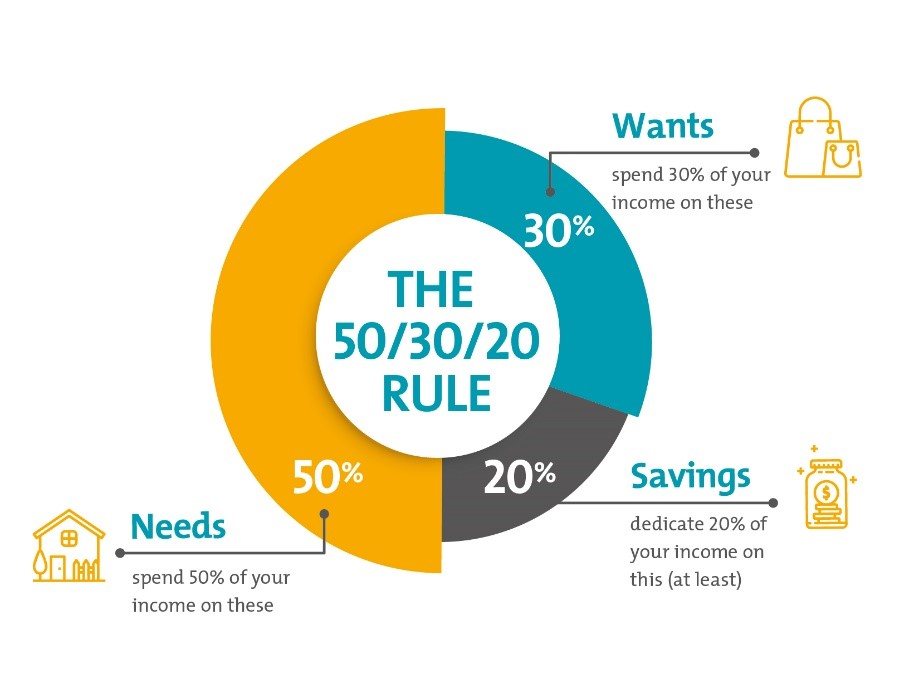

Embrace the 50/30/20 Rule

Allocate 50% of your income to necessities, 30% to discretionary spending, and 20% to savings and debt repayment. This balanced approach ensures you’re not only saving but also managing your debt efficiently.

Cut Unnecessary Expenses

Identify expenses that can be trimmed or eliminated. Consider alternatives for costly habits, such as dining out or excessive shopping. Redirect the funds saved towards debt repayment.

Automate Savings and Debt Payments

Set up automatic transfers to a dedicated savings account and for debt payments. Automation ensures consistency and prevents the temptation to spend before saving or repaying debts.

Negotiate Bills and Interest Rates

Contact service providers to negotiate bills, and explore options to lower your interest rates on credit cards or loans. Even a slight reduction can make a significant impact over time.

Generate Extra Income

Consider taking up a side gig or freelancing to supplement your main income. The additional funds can be directly channeled towards debt repayment or building your savings.

Use Windfalls Wisely

Whenever you receive unexpected windfalls, like tax refunds or bonuses, resist the urge to splurge. Allocate a portion towards paying off debts and boosting your savings.

Implement the Snowball Method

If motivation is a challenge, use the snowball method. Pay off the smallest debts first and gradually work your way up to larger debts. The sense of accomplishment can drive you to tackle bigger challenges.

Stay Committed

Consistency is key. Stick to your budget, debt repayment plan, and savings goals even when progress feels slow. Remember that small steps today lead to significant financial freedom tomorrow.

Discover a path to financial freedom with effective Debt-Free Tips. Achieving a debt-free life while building savings demands dedication, patience, and strategic planning. By embracing these strategies, you’ll not only alleviate debt but also secure a healthier financial future. With every small victory, you’ll inch closer to the freedom of choice that aligns perfectly with your aspirations.

Leave a Reply